Cnsistore Reviews 2023 Best Cnsistore Reviews With Details

September 12, 2022

Are Tornadoes In Battle Lab 2023 What Are Tornadoes?

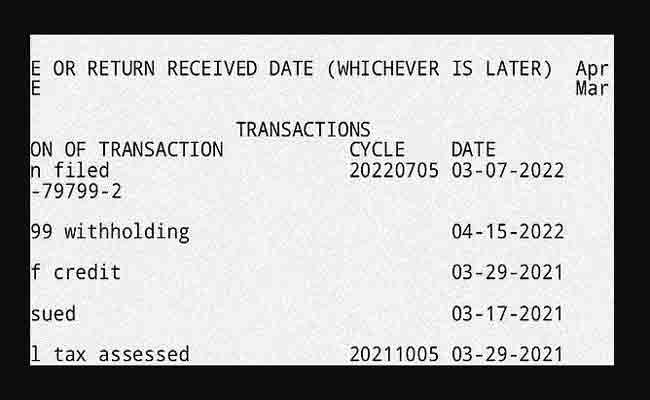

September 14, 2022Code 150 On Irs Transcript 2022 All About Irs Code 150 On Transcript 2022 is our todays topic. Have you read the transcripts of the processing dates in the wages account? If you want to learn all you can about accounts and wage transcripts, go here for more information.

Users in the United States have received a second version of the problem, which reverted to the original date to complete the resequencing of the report produced on February 28, 2022.

Return on February 14th, 2022 as a reminder to process ideas. Monday is the last day in the cycle seen on the graph. IRS experts have offered specific Code 150 on IRS Transcript 2022.

IRS Code 150 On Transcript All About 150 Code Irs

What Is Code 150 On Irs Transcript 2022?

What Does Code 150 Mean On Tax Transcript? Code 150 states that a tax refund will not planned based on a transcript with a value of 0.00. A transcript that corresponds to the tax line in the 24 covid-1950 is a technical zero tax situation on income. Thus, a person with a lesser income might get no tax deduction if he qualifies for lines 27, 28, and 29 for tax refunds for children.

To take advantage of a refundable credit, the individual cannot ask for the largest amount of $10,000 or avoid paying income taxes. More information about Code 150 from IRS Transcript 2022 may discover in the following article.

Date Of Payment Code 150 Code 150 On Irs Transcript 2022 With Amount

A person who has accord the E File Status of 150 or who has submitted a tax refund request with the number 792 114 6709 781 in an amount more than $1 will not allowed for a refund. If they utilized the alert button in the privilege and wish to claim it back, they must come to our tax department by June 15th.

The IRS community analyses the tax requirements that have authentic in a simple way utilizing the transcripts for code 846, which has drop but will return code 150 by 2021. Customers must stay in compliance to earn internal maintenance reimbursements, according to Code 150 in IRS Transcript 2022.

How To Make A Claim

The five-week week features calendar dates that enable accounts to be up and running with direct deposit deadlines for refunds and taxes, according to the IRS cycle week. There are other various ways to get full-time codes:

Upload the predicted transcript to the 2021 tax transcript using the US IRS system. The return file will made accessible to you. The following year, before February 28, the process dates for this bath cycle result in an account of the tax due to you.

Benefit Code 150 On Irs Transcript 2022

According to evaluations and a series of movies, it is evident how code 150 Irs may applied to authorized person withholdings. The individual who receives the money only by claiming it from the government, and from which the government deducts a share.

Conclusion

At the end, Our specialists believe that the algorithm utilized in that approved reimbursement, dates of the code 150 transcripts firm.

Are You Acquainted With The IRS’s Tax Return Filing Guide?

Your feedback respect here. Transcripts for the 15th of February 2022 are accessible via the processing department. And Account Coding Code 150 of IRS Transcript 2022.